The Hive Retirement Process

A clear, step-by-step approach to retirement — designed to reduce worry and improve decisions.

Five connected decisions, designed to work together — not in isolation.

STEP ONE: CLARIFY

Understand what retirement will really cost - before you make big decisions.

We help you get clear on your lifestyle, priorities, and spending so you know how much you need to retire, and when.

This creates the foundation for confident retirement spending planning — without second-guessing the numbers.

STEP TWO: GENERATE

Create reliable monthly income you can count on.

We design income from your investments, Social Security, pensions, and other sources so your retirement paychecks feel predictable and dependable — even in uncertain markets.

This is where your savings becomes into a sustainable retirement income plan, built to last as long as you do.

STEP THREE: PRESERVE

Reduce taxes so you keep more of what you’ve earned.

Taxes are often the largest expense in retirement — bigger than healthcare.

We focus on lowering your lifetime tax bill through smart withdrawal strategies, Roth planning, and coordinated income decisions to protect what you’ve built.

STEP FOUR: INVEST

Invest with confidence — even in bad markets.

Your investments are aligned with your retirement timeline so growth, income, and risk work together — not against you.

We focus on evidence-based investing that supports your plan, rather than chasing headlines or predictions.

STEP FIVE: LEGACY

Protect your family and create a lasting legacy.

We help ensure your plan holds up through life changes — and that your wealth passes where you intend, with clarity and fewer surprises for your family.

Legacy planning is about more than documents — it’s about peace of mind for the people you care about most.

A clear, step-by-step approach to retirement — designed to reduce worry and improve decisions.

The Hive Retirement Process™ is a collaborative retirement planning process built to answer the questions that actually determine retirement success — your retirement income, taxes, protection, and longevity.

We start with retirement income and tax strategy, then align investments and estate planning to support your goals.

No cookie-cutter plans. No unnecessary complexity. Just clear decisions, built around your life.

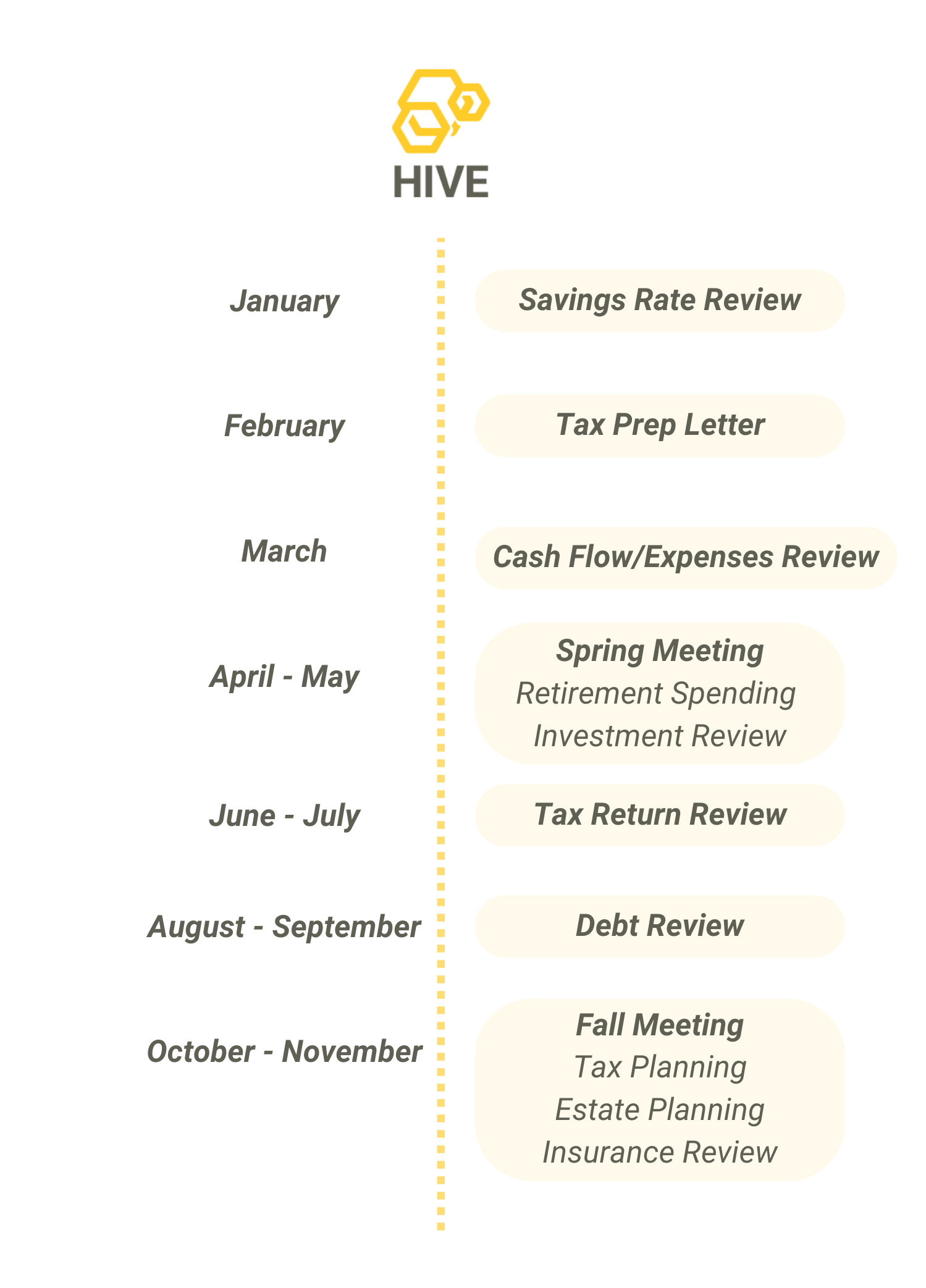

Annual Service Calendar

As a new client we’ll have several onboarding meetings to create your financial plan with action items towards a fulfilling retirement. Your financial plan will serve as our touchstone and will be constantly updated

Throughout the year we’ll focus on different areas of your finances

- Semi Annual meetings (at a minimum) via Zoom for bigger topic reviews and to update for any changes in your life

- Deeper dives on various areas throughout the year. For the sake of your scheduling, these reviews are often asynchronous with a video or email update

- Rapid Response to emergencies. Regardless of where we are in the service calendar, we are always available to respond to emergencies or time sensitive projects - let's meet and figure it out

Areas that we'll work on throughout the year:

Tax Planning - Even though we all love paying low taxes each year, our main goal is to lower your lifetime tax bill through planning such as Roth conversions.

Retirement Income - We'll review your various accounts and lay out how to best use your savings in your retirement years. We take many factors into consideration including your income sources, expenses and what's important to you and your family.

Estate Planning – Having a will and/or trust-based estate planning is an essential part of your financial plan, as well as for your end of life decisions when you are unable to speak for yourself. We can refer lawyers for estate planning and we can assist in more basic situations. If you already have an estate plan, we will review to make sure it still reflects your wishes.

Investment Review - We look at your holdings to make sure it accurately reflects about how you feel about investing. For clients needing assistance with managing their investments, Hive Retirement offers investment management services. Our thesis is to keep things simple: a portfolio of low cost index funds which are rebalanced quarterly. We also perform tax loss and gain harvesting, as dictated by market conditions.

Insurance Review – We do not sell insurance or any financial products. We'll evaluate your insurance and we are your fiduciary at all times in evaluating your financial decisions.